What is Asset Allocation?

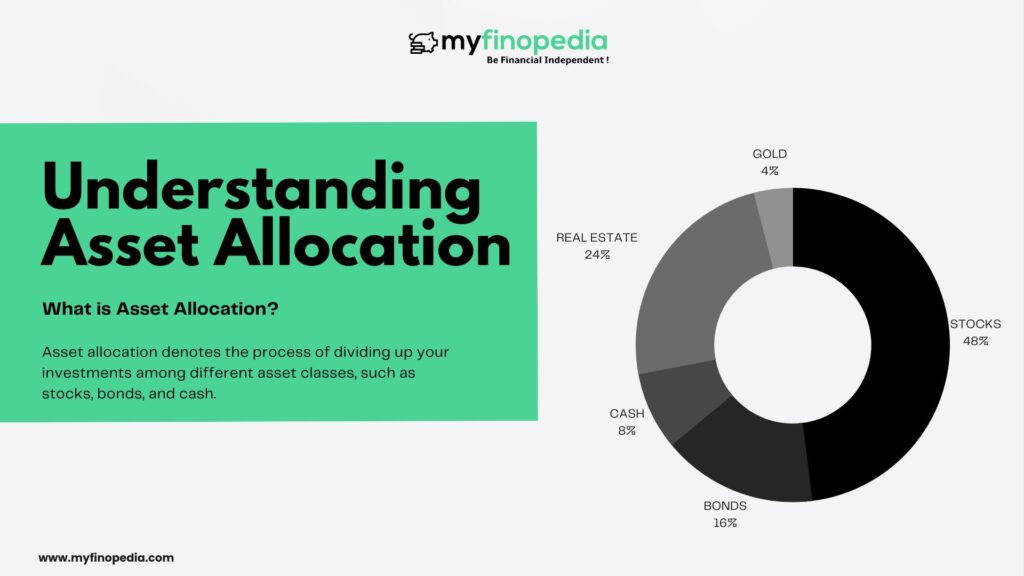

Asset allocation denotes the process of dividing up your investments among different asset classes, such as stocks, bonds, and cash. The goal of asset allocation is to manage risk and enhance the likelihood of achieving financial goals.

In this article, let us discover various forms of asset allocations based on an individual’s risk appetite & investment goals.

What is an Asset Class?

An asset class refers doing group of financial instruments that figured similar characteristics and tend to behave similarly in the market. These main kinds of assets are respectively:-

- Equities: Equities, or stocks, represent ownership shares in a company listed as known for her their potential for high returns compare to others classes. However, equities also carry a higher level of risk and volatility.

- Fixed Income:- Fixed income assets consist of bonds, which are essentially the loans made to governments or companies. Bonds are generally considered less risky than stocks, and they offer regular interest payments.

- Cash and Equivalents: – Cash and Equivalents encompass short-term investments like money market funds, equities, certificates of deposit (CDs), government bonds, etc. This asset class is considered the safest, with minimal risk. However, it also offer the lowest potential returns.

Below are some other profiting key asset classes that involve low risks and high returns:- - Gold Assets: – Gold brings security and safety in terms to emergency money withdrawal or as a hedge of value of security. Besides, in case of inflation, it proves be great liquidity of assets.

- Real Estate: – The realestate is suitable place for allocation of assets as it’s high investments. By investing in REITs (Real Estate Investment Trust), an individual can have a faster and more early profits.

How does asset allocation work?

Asset allocation works by distributors investments across the various asset classes. This strategy helps to mitigate risk because if one asset class experiences a decline, other assets classes may compensate by performing better. For example, during a stock market volatility the value of bonds may rise.

Determining the optimal asset allocation depends on individual circumstances, including factors such as age, risk tolerance and financial goals. Seeking guidance from a financial advisor can assist in creating a personalized asset allocation plan.

Importance of Asset Allocation

Asset allocation holds significant importance in determining the success of an investment portfolio. A well-diversified portfolio is less susceptible to significant losses in any given year, and is more likely to achieve long-term financial objectives.

How to Choose Asset Allocation?

- Age: Generally, as individuals grow older, they may prefer to shift their asset allocation towards less risky investments, such as bonds. This approach helps to preserve capital and reduce exposure to market volatility.

- Risk Tolerance: Evaluating personal risk tolerance is vital. Investors uncomfortable with substantial risk may opt for a more conservative asset allocation, emphasizing fixed income assets and cash equivalents.

- Financial Goals: Different financial goals required different asset allocations. For instance, those saving for retirement may choose a more aggressive allocation to pursue higher long-term returns.

Rebalancing your portfolio

Over time, the asset allocation in a portfolio may deviate from its intended allocation due to market fluctuations or changes in personal circumstances. Periodically rebalancing the portfolio is essential to realign it with target allocation, ensuring it remains in line with goals and risk tolerance. The earlier you start investing in equity, bonds or real estate funds, the more consistent your asset management becomes. If you are looking for bracelet. There’s something to suit every look, from body-hugging to structured, from cuffs to chain and cuffs.

Conclusion

Asset allocation plays a vital role in any investment strategy. By diversifying investments across various asset classes, investors can reduce risk and enhance their prospects of achieving financial goals. It is recommended to seek professional advice to design an asset allocation plan tailored to individual circumstances.