“Maximize Your Tax Savings in 2022-23 – Secure Your Future With Tax Saving Options For Salaried”

People who are salaried have some advantages when it comes to submitting income tax returns. In this blog post, we’ll talk about tax-saving solutions for salaried people for the AY 2022–2023. We will also discuss the steps what one should do before filing their ITR and how they can maximize their benefit under the current tax code. This blog post will help readers comprehend all of the tax saving alternatives accessible to salary earners for the upcoming fiscal year, allowing them to make well-informed decisions to improve their savings.

We are all aware of the negative impact taxes may have on our take-home pay, which is why it is crucial to comprehend and utilise the tax planning opportunities accessible to salaried people. We will discuss the many tax-saving choices for salaried individuals in the next Assessment Year 2022–23 based on important variables like safety, flexibility, returns, liquidity, transparency, taxability, etc., and how you may make smart decisions to save a little more money!

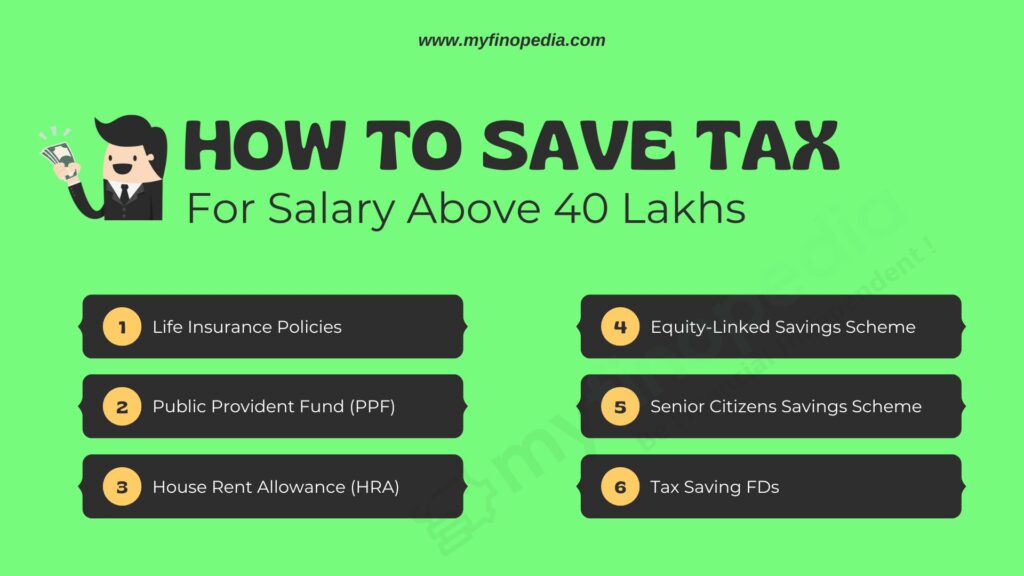

Steps To Save Tax For Salaried in 2022-23

- First, Take advantage of the additional deductions under section 80C, which are up to Rs. 1.5 lakh, by investing in recognised pension schemes like NPS or PPF. The NPS has emerged as the top option for cutting taxes in 2023, reflecting a major change in this year’s rankings. NPS investments have not performed well over the previous year, with all categories—aside from alternative investment funds—delivering less than 4%. In 2022, bonds and stocks both declined. Bonds are in a stronger position, despite the fact that equities markets do not appear to be very solid. Analysts anticipate a 25 basis point increase in the repo rate from the RBI in February.

The Returns for NPS is 8-11% in the past five years while the Lock-in period is Till retirement.

The Public Provident Fund (PPF) is more desirable than bank deposits since it is tax-free. Small savings plans’ interest rates are correlated with the yields on government bonds. While interest rates stayed steady in 2022, government bond yields continually increased. The Senior Citizens’ Savings Scheme’s interest was the only thing raised.

The Returns for PPF is 7.1% in 2023 while the Lock-in period is 15 years from inception.

- Second, HRA offers non-salaried taxpayers the chance to reduce their tax liability on rental payments made through investments made in accordance with section 80GG. For those receiving a home rental allowance (HRA), a rent exemption is permitted up to the lesser of the real HRA received, the actual rent paid as deducted by 10% of basic pay, or 40% or 50% of basic pay (depending on the location of accommodation). A deduction that is the least of the following is permitted for those who do not get HRA, subject to certain restrictions: Actual rent paid is equal to Rs. 60,000, or 25% of total income, less a deduction of 10%.

- Thirdly, ULIPs have increased this year as well, and for the same causes as the NPS. In the upcoming months, a ULIPs debt funds may generate a profit. The transition from stock to debt, and vice versa, is tax-free. In contrast to NPS, where the investor can switch the management of the pension fund, in this case the buyer is obligated to use the insurance firm for the duration of the term.

The Returns for PPF is in between 8-9% for last five years while the Lock-in period is minimum 5 years.

- The Senior Citizens’ Saving Scheme (SCSS), which was previously the greatest investment choice for individuals over 60, had its interest rate increased to 8% last week. Senior persons receive a tax exemption on interest up to 50,000 even though it is fully taxed as income. Pension payments are made by the plan at the beginning of each quarter. It gives a better rate of return than the PPF at 8%.

The Returns for SCSS is 8% for JAN-MARCH 2023 last while the Lock-in period is 5 years.

- There are also hybrid retirement mutual funds that are deductible from taxes under Section 80C.. These funds have a longer lock-in duration of five years as opposed to ELSS plans’ three years. The tax advantages of long-term profits from equity funds do not apply to capital gains from these hybrid funds. Retirement mutual funds, on the other hand, can also be hybrid in nature and qualify for a tax credit under Section 80C. These retirement funds are appropriate for investors who have a low risk tolerance and wish to invest for the long term.

The Returns for Retirement Mutual Funds is 7-13% in the last three years while the Lock-in period is 5 years.

- Corporate earnings might be negatively impacted in the upcoming months due to worries about a global recession, high inflation, and slowing demand. ELSS funds perform well across the board. The three-year lock-in term is the shortest of all the tax-saving choices, and they are straightforward and quite affordable. Taxpayers can still use the SIP method, though, by spreading out their investments over the following two months. If you need to provide evidence of Sec 80C investments in a few days, this is not achievable.

The Returns for ELSS Funds is 10.01% in the last three years while the Lock-in period is 3 years.

- In health insurance premiums, there deductions up to Rs.25000 is allowed for payment of health insurance premiums under Section 80D. A taxpayer, whether an individual can claim deduction under section 80C in respect of the premium on a life insurance policy that was paid by him or her during the year. Under this Section, a HUF (Hindu Undivided family) or senior citizen of taxpayers only can claim deduction in form of top-up plans, in addition to a number of other things allowed under the provision.

Click here for more info: TAX BENEFITS DUE TO INSURANCE POLICIES PDF!

Along with this, the deductions benefit their spouse, self, children or parents who are dependent to them with a separate deduction covered in the policy. However, any other body or entity can’t claim the same as of the firms or companies in this section.

The Returns for Health Insurance premium is in between 5-6% while the Lock-in period is 3 years minimum.

- Tax-saving FDs have the significant benefit that investments may be made fast and easily. Simply log on to your Net-banking account, and it only takes a few mouse clicks. Although NSCs provide a somewhat lower interest rate of 7%, the money generated on them is still deductible in subsequent years.

A fixed deposit account type that qualifies for a tax deduction under Section 80C of the Income Tax Act of 1961 is a tax-saving fixed deposit (FD) account. Any investor who opens a tax-saving fixed deposit account is eligible to deduct up to Rs. 1.5 lakh annually.

The Returns for NSCs, tax-saving FDs are in between 7-7.6% years while the Lock-in period is 3 years.

Conclusion

The approaching AY 2022–2023 offers several opportunities for salaried people to reduce their tax burden. The greatest strategy for reducing your tax burden is to choose the solution that best suits your needs and financial situation. When it comes to salaried workers, tax preparation is a crucial component of financial planning. You may choose the best course of action and ensure that you don’t overlook any legal deductions by doing research and consulting with a financial expert.

Returns and Data Source: ET Wealth