Recently John Reade, Market strategist at World Gold Council of Europe & Asia talked about the importance of gold as a strategic asset to strengthen market portfolio. With the ongoing market volatility & fluctuations, many investors had turned towards gold as a way to diversify their portfolios and protect wealth.

There are different cases that make the case if gold investing is strong. Several points are given in the following:-

1. Hedge against Inflation

Gold has historically been a hedge against inflation, as its value tends to soar during the time. This is because the supply of gold is limited and it cannot be easily created or destroyed like a paper currency. As Central banks continue to print money and inject liquidity in the economy, the value of paper currency may decline, making gold an attractive option for investors looking to preserve their purchasing power.

2. Diversification

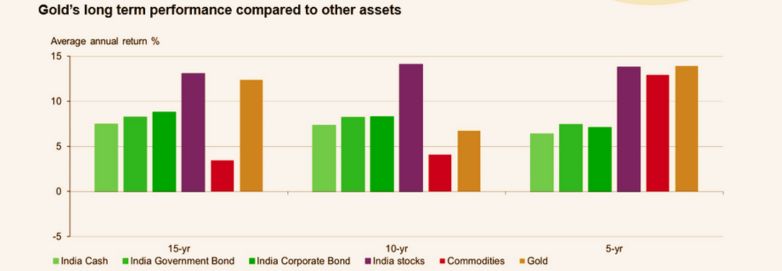

Gold is a non-correlated asset, meaning its performance is not closely tied to the performance of other assets in the stock market like equity or bonds. It makes certain effective ways to diversify a portfolio and reduce the risk during market volatility. As a matter of fact gold may hold its value more than other assets providing a stabilizing influence on the portfolio.

3. Emergency Corpus

Gold has been used as a store of value for centuries and its value stands out the test of time. Unlike paper currency, which can be subject to inflation and devaluation, gold maintains its value over the long term. For example, during emergency periods like War, Covid 19, real estate increase, it will provide the liquidity and strengthen the purchasing power of the investor.

4. Portfolio Insurance

Gold always serves as an insurance for a portfolio, providing protection against market downturns and economic uncertainty. In times of crisis, gold may value better than other assets, providing a hedge against losses and helping to reduce overall portfolio risks.

5. Global Demand

Gold is a globally recognized and accepted form of currency, and its demand is not limited to specific regions or markets. This means that gold can provide a level of stability and liquidity that other assets may not be able to match.

Final Words

The case of gold investing is a profitable option particularly in light of the ongoing economic uncertainty and market volatility. By including gold in a diversified portfolio, investors may be able to reduce overall risk and provide a stabilizing influence on their investments.