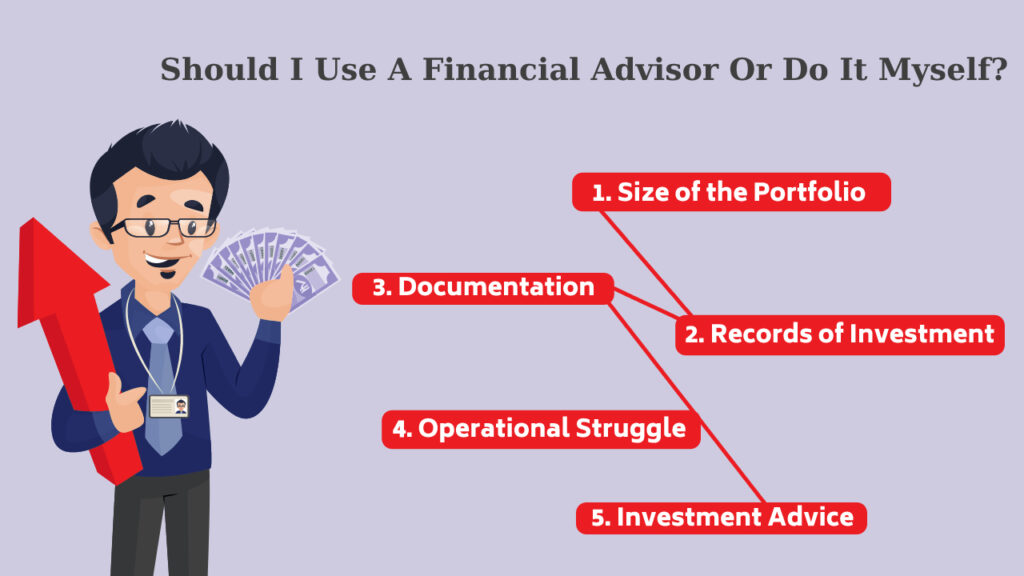

Should I Use A Financial Advisor Or Do It Myself?

An advisor will help you in selecting the right funds for inculcating investment discipline to achieve financial goals in the given time period. If one desires to seek professional advice from a SEBI registered Investment Advisor or a financial planner. A SEBI’s registered Investment Adviser will charge for the bouquet of services provided. It’s high time that one …

Should I Use A Financial Advisor Or Do It Myself? Read More »