Options trading allows traders speculate on stock market’s future direction or particular instruments such as stocks. An option refers to a contract which gives a buyer the right, but not the obligation, to purchase (in the case of a call) or sell (in the case of a put) underlying asset at a specific price on or before certain date. Options are derivatives as they derive their value from an underlying asset.

Introduction to Options Trading

Trading stock options is more complex in comparison to trading stocks. In stocks’ trading, a trader purchases a stock by just specifying the desired number of shares. Then the broker fills the order at prevailing price or a limit price which is being set by trader. Options trading necessitates an awareness about advanced tactics, and opening an options trading account entails a few extra steps than opening a standard investment account. Options are known as another asset class. If used correctly, they might provide several advantages which trading stocks and ETFs alone cannot.

Stock market saw significant volatility in 2022 as a result of fears related to inflation, Russia’s invasion of Ukraine, higher oil costs, etc. According to managing director of trading and derivatives with the Schwab Center for Financial Research Randy Frederick, trading in options significantly increases when the market turns volatile. To quote him, “You can use options to speculate and to gamble, but the reality is … the best use of options is to protect your downside.” “Options are one way to generate income when the markets aren’t going up.” According to data by Options Clearing Corporation, 939 million options contracts were executed in Mar 2022, exhibiting 4.5% improvement against Mar 2021.

Therefore, Mar 2022 was second-busiest trading month on record.

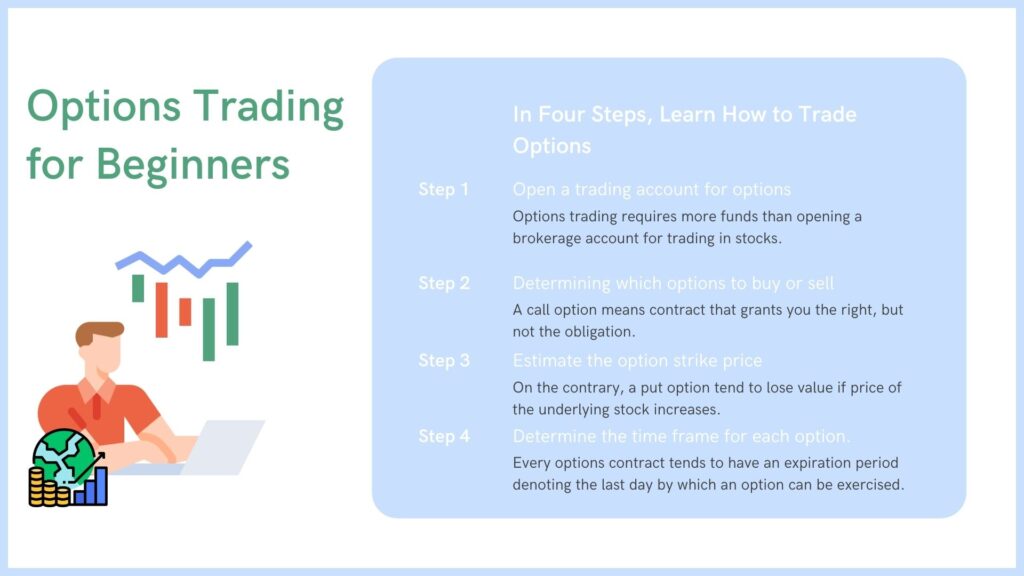

In four steps, learn how to trade options

- Open a trading account for options

If you want to start trading in options, you are required to furnish some additional documents than what you would have submitted at the time of opening a normal investment account. Options trading requires more funds than opening a brokerage account for trading in stocks. Before allowing you to open options trading account, brokers will need to learn more about you. Brokerage firms are required to screen potential option traders to monitor and assess their market knowledge, risk management, and financial background.

- Determining which options to buy or sell

The next step is determining which option to buy or sell. A call option means contract that grants you the right, but not the obligation, to buy a stock at a specified price — known as the strike price — within a specified period. A put option offers the trader a right, but not the obligation, to sell shares at a certain price before the expiry of the contract.

Want to learn more about Call Options vs. Put Options ? Check Here !

Purchasing the type of option depends on whether you expect the underlying stock to rise or decline in future.

– If you expect that the share price will increase in value, you should go ahead with purchasing a call option or selling a put option.

-If you expect that the share price will not see a significant movement, you should consider selling a call option or a put option.

-If you expect that the share price will fall in the near future, you should consider purchasing a put option or selling a call option.

- Estimate the option strike price

When purchasing an option, it is only beneficial if the option ends “in the money” at the end of the expiry. Traders are required to purchase an option having a strike price which corresponds to where they believe the stock will be during the lifespan of the option. For example, a put option will become more valuable as price of underlying stock or security falls. On the contrary, a put option tend to lose value if price of the underlying stock increases.

- Determine the time frame for each option.

Every options contract tends to have an expiration period denoting the last day by which an option can be exercised. Expiration dates range from few days to several months or even years. Daily and weekly options are the trickiest ones and they should only be traded by seasoned option traders. Monthly and yearly expiration dates are for the long-term investors. This is because longer expiration periods offer more time for the stock to move and for an investment thesis to play out.

Why should you trade options?

Options trading has several advantages after you master the strategies involved in it and after you decide to put an extra effort. Stocks provide higher return on higher risk, while options take that a couple notches higher. In options, there is a possibility of getting your money doubled or tripled (or even more) at the risk of losing it all.

According to Frederick, most of the covered calls are sold out of money, generating income immediately. Options are considered for trading due to the advantages attached to it. Some of the advantages include leveraging, hedging, potential to make money even in sideways market, etc. Options tend to help in hedging long-term stock positions a lower cost. In options trading, hedging means establishing a position to reduce the exposure to price volatility in some opposite position in futures or equities. An option trading enables a trader to establish positions which can make money when the market goes up, down, or trades in a range. On the other hand, owning shares will allow investors to make profit only when the stocks move up.