Which Mutual Fund Should Investors Select—Debt or Equity?

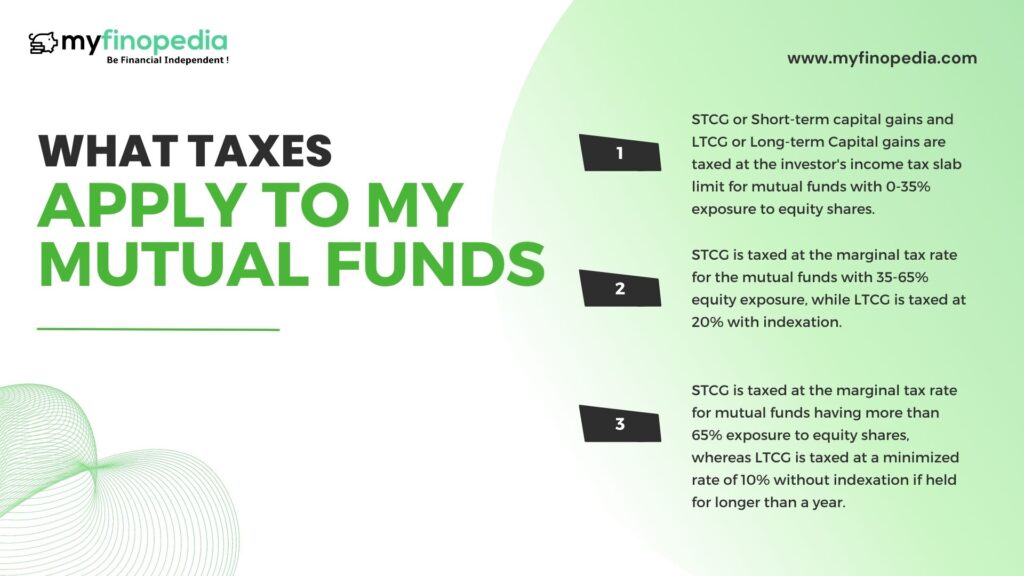

When evaluating their financial alternatives, people frequently struggle to decide between debt and equity mutual funds. As we know that each of these investment varieties have their own distinct qualities and advantages of their own, as an investor and having an aim of a safe financial goal, you must make an important decision regarding this. …

Which Mutual Fund Should Investors Select—Debt or Equity? Read More »