Not all of your income will be yours even after your retirement. The tax element comes into play. This will reduce the amount that an individual has in their hands. One needs a careful estimation as well as proper knowledge to tell when and how the retirement amount will be taxed and the kind of impact that will have on the income.

The first step is to ensure that the entire list of items from which the income is going to be generated is made. The income from each item has to be considered to see whether the amount is actually taxable or what is the nature of the tax treatment for the person in that specific case. In the final analysis, this will enable one to know the kind of action that should be taken for tackling the matter. There is a need to take a very careful look at the taxation part of the income for several reasons:

The Method Of Taxing Income Is Not Uniform For All Sources

Since the retirement income will come from different sources, tax treatment of all the items will not be the same. For example, while pension from an employer is considered as income from salaries, a return from the pension plan of mutual funds the difference or the gain will be considered as capital gains.

Even The Rates Of Tax Are Not Uniform

In some cases the income will be taxed at the highest rate of tax applicable to an individual which would be 30%, while in other cases the return or the income would be subject to a specific tax rate that could be 10% or even 20% depending upon the situation and the way in which the entire thing has to be conducted.

There is no way that a person can just say that if there is some retirement income it will be subject to a certain rate of tax. There is a higher limit of Rs 1,85,000 that is the basic limit for the taxation of income for senior citizens who are above 65 years of age. Again, the age factor will also play a role in determining the applicable tax rate for the individual.

The Amount Of Tax Will Reduce The Level Of Income For The Individual

The tax amount will eat into the income and the individual will get the benefit of only the net figure. This means that the investor will end up receiving a sum that is lower than what would have come if one considers just the returns on the whole investments. This is a way in which the tax is an impediment in the return earning process for the individual.

Consider The Refund

In several cases, the tax structure is such that the tax is collected at an initial stage either through deduction at source. Then at a later point of time a part of this is also refunded when it is found that the tax that has been collected or paid is more than what is actually due under the various provisions of law. One also has to consider the refund element in the process.

Cash Flow Impact

While one is considering the final returns angle, the first hit of any taxation is that it will impact the cash flow. This is the immediate impact in most cases and the person at the receiving end is the individual who has to figure out ways to raise funds elsewhere. One also has to provide for some additional amount as it could throw the entire retirement planning process out of gear.

Ways Of Paying Tax

There are two ways in which the tax will impact the investment and the income that arises from such investment. The first method is the tax deduction at source. This can be done when income is generated from specific areas and the amount of deduction is calculated at a specified rate and then deducted at the time of the payment itself. The individual will get access to only the net amount. On the other hand, the individual has to make the calculation and then pay the required amount of tax either as advance tax or a normal self-assessment tax at the time of filing the tax return.

Employees Pension Scheme

Under the employer’s pension scheme, the individual will receive a pension after they reach the required age. This will be a monthly receipt that will be an income. This income will then be subject to tax at the applicable rates for an individual. In other words, the pension will be considered as normal income and the tax would be calculated on this figure.

Pension From Employer

This will also be considered as income for the individual and since this arises on account of a past employer- employee relationship the amount will be taxed under the head salaries. The individual will have to pay tax on the income arising through this route as if it is normal income and hence the applicable tax rate will apply.

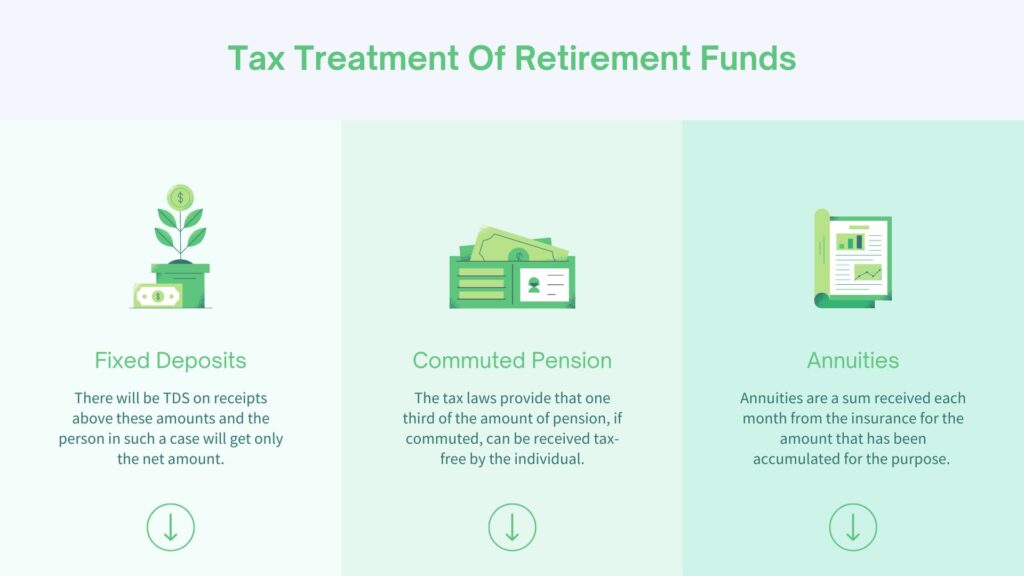

Commuted Pension

The tax laws provide that one third of the amount of pension, if commuted, can be received tax-free by the individual, where he is a non-government employee and he receives gratuity. If he is a non-government employee and gratuity is not received then half of the commuted pension is exempt from tax.

Annuities

Annuities are a sum received each month from the insurance for the amount that has been accumulated for the purpose. They are expected to play an increasingly important role in the way in which the payment is available at the time of retirement. The amount that is received on an annuity is taxable. This means that the amount received is income for the individual and this is then taxed at applicable rates.

Senior Citizens Savings Scheme (SCSS) The amount of income here is generated in the form of interest each quarter. This is the amount that is paid out to the individual as the earning from the scheme. This amount is taxable in the hands of the receiver. The post tax return will depend upon the tax bracket of the individual. In addition, there is another angle of the scheme that has to be understood because this has a very important impact on the final and overall returns. There will also be a tax deduction at source from the income earned by the investors from the scheme. For those who have no income taxable this could mean that they will be subject to the tax burden if they are not careful and fill in the required forms for exemption or claim the refund. Several investors might not have the required amount as taxable because their income is less than the total taxable figure. Such senior citizens need to fill in the necessary Form 15-G or 15-H. Only then will the TDS not take place. Any TDS that has occurred will have to be adjusted at the time of filing of the tax returns and the necessary refund or other benefit has to be claimed.

Fixed Deposits

There are two tax aspects that are present here too. The first is the TDS angle, which will take place when the earnings from interest is more than Rs 5,000 for an investor with a particular branch. There will be TDS on receipts above these amounts and the person in such a case will get only the net amount.

The next is the receipt of the interest itself, which is taxable in the hands of the investor. This will have to be included in the income and then it will be taxed. The earlier limit under Section 80L for deduction of the interest earned on such deposits is no longer present and hence the entire amount will be taxable.

Another tax benefit has just been introduced from 2006 April for some categories of fixed deposits. Deposits, which are for 5 years or more, will be eligible for the benefit under Section 80C up to Rs 1 lakh as a deduction from income. Under this section, eligible investments are allowed as a deduction from the income of the individual. The scheme has to have a lock in of a minimum of 5 years and also have to meet the other conditions that are listed out under the scheme notified by the government.

Monthly Income Scheme

The post office monthly income scheme has very few tax benefits. The interest will be taxable in the hands of the receiver and there is no element of benefit or relief available anywhere. However, there is no tax deduction at source and this is a relief for investors. The income will have to be considered for the purpose of taxation in the year in which the amount is generated and received as the payout.

Monthly Income Plan Of Mutual Funds

These schemes pay out a regular dividend each month. The amount that is received as dividend is tax free in the hands of the investor. However, there will be an indirect impact in the form of dividend distribution tax that will be charged to the scheme and the NAV when the payout is made. If there is a capital gain then this too would be subject to tax.