In today’s world, where digital transactions have become a norm, it is important to know if your bank is safe. With the global banking system facing a crisis, it is vital to understand what this means for you and your finances.

The recent havoc from Silicon Valley Bank and Signature Bank, along with the merger of Credit Suisse with UBS, has caused anxiety about the threat of contagion. Governments and central banks are working to contain the fallout, but the threat of contagion remains.

In the case of Indian banks, the Reserve Bank of India has been proactively managing banking failures from global financial blow-ups. However, the storm brewing overseas can change it, and depositors must remain vigilant and assess if their money is safe or not. The recent global collapse of the Silicon Valley Bank was not a result of faulty loans or malfeasance, but due to the outcome of high-interest rates. The value of these investments was significantly diminished by the rising interest rates for a bank like SVB since it had an exceptionally high proportion of assets preserved as investments rather than loans. The bank’s deposit franchise included a sizable amount of liabilities that did not pay interest and are comparable to current account deposits in India. These deposits can be quickly and in large quantities removed. However, when a sizable portion of these deposits abruptly left the bank, it was forced to liquidate its holdings at a significant loss, which sparked a typical run on the bank.

According to experts, what occurred at a few local American banks cannot occur in India. Indian banks use their assets mostly in advances, with investments making up just 25% of the assets, making it less susceptible to market shocks brought on by increasing interest rates. While American banks’ investment books contain various exposures, Indian banks’ investments are mostly in government securities.

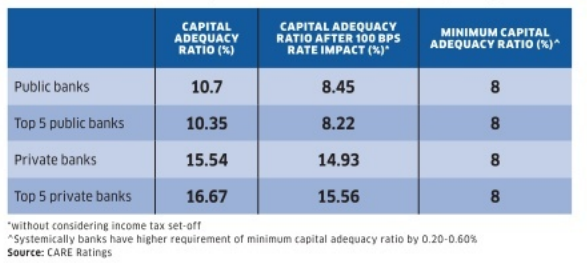

Nevertheless, domestic interest rates have grown much more slowly than in the US, and Indian banks have enough cushion to handle changes in interest rates. With their high levels of capitalism, private sector banks, particularly the bigger ones, may not be significantly affected by the interest rate increases. Since public sector banks have a greater percentage of held-to-maturity investments relative to their net worth, the impact on them is probably going to be minor. Most Indian banks have a more balanced deposit base than SVB or other local US banks, and asset-liability management and the timing of cash inflows and outflows are seen as essential elements of baking. The article offers guidelines on how to recognize warning indicators and advises depositors to exercise caution and determine if their money is safe.