Introduction

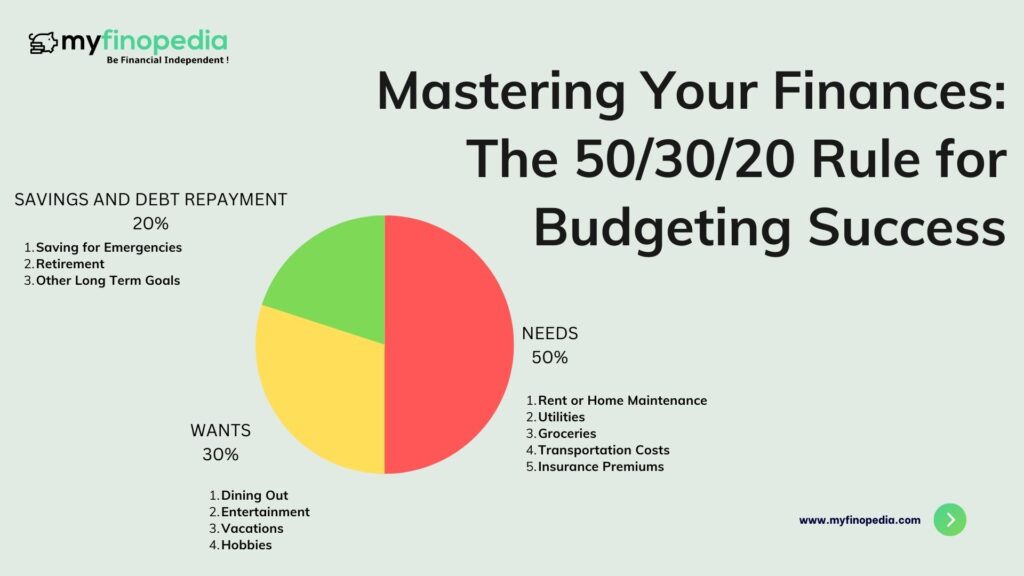

The 50/30/20 rule is a financial guideline that helps individuals manage their money effectively by allocating their income into three distinct categories: 50% for needs, 30% for wants, and 20% for savings and debt repayment. This rule provides a simple and practical framework for budgeting and financial planning, helping people achieve financial stability and achieve their long-term goals.

What is 50/30/20 Rule All About?

The first component of the 50/30/20 rule is the allocation of 50% of your income to NEEDS. These are essential expenses that you must cover to maintain a reasonable quality of life. They include things like rent or home maintenance, utilities, groceries, transportation costs, insurance premiums, and minimum debt payments. This category ensures that you meet your basic needs and obligations.

The second component comprises 30% of your income for WANTS. These are expenses that enhance your lifestyle and provide enjoyment but are not strictly necessary for survival. Examples of wants include dining out, entertainment, vacations, hobbies, and non-essential shopping. Allocating a portion of your income to wants allows you to enjoy life and reward yourself while staying within a budget.

The final component wants 20% of your income for savings and debt repayment. This is where you build your financial future. In this category, you should prioritize saving for emergencies, retirement, and other long-term goals. Additionally, if you have outstanding high-interest debt, such as credit card balances, this category can be used to accelerate debt repayment. Reducing debt helps free up more money for savings in the future.

Implementing the 50/30/20 rule begins with understanding your income and expenses. Start by calculating your after-tax income, which is the amount you take home after taxes. Then, track your spending to categorize your expenses into needs and wants. Adjust your lifestyle as necessary to align with the 50/30/20 ratios.

How Can I Efficiently Carry Out this Rule?

Here are some key tips for effectively using the 50/30/20 rule:

1. Create a budget- Develop a detailed budget to track your income and expenses. Use budgeting apps or spreadsheets to simplify the process.

2. Emergency Funds- Prioritize building an emergency fund with the savings category. Aim to save at least three to six months’ worth of living expenses to cover unexpected financial setbacks.

3. Debt Management- If you have high-interest debt, focus on paying it down aggressively. Once your debt is under control, redirect that 20% towards savings.

4. Adjustment- Life circumstances change, so be prepared to adjust your budget when necessary. This flexibility is essential for long-term financial success.

5. Long term plans- Use the 20% savings category to work towards long-term goals like buying a home, funding your children’s education, or retiring comfortably.

In conclusion, the 50/30/20 rule is a straightforward yet effective method for managing your finances. By allocating your income into these three categories, you can maintain financial stability, enjoy some of life’s pleasures, and build a secure financial future. Remember that financial planning is a dynamic process, so regularly review and adjust your budget to stay on track and achieve your goals.