In an overnight move, the Reserve Bank of India (RBI) has announced the withdrawal of the ₹2000 rupees notes from circulation. But, it is also significant to know that these banknotes will continue to hold status as legal tender. Let’s dive into the details of this decision and its implications for the public.

The RBI’s decision to withdraw the RS. 2000 denomination notes. This move aims to address concerns related to the hoarding of high-value currency and to promote a more efficient and transparent payment system.

The ₹2000 denomination banknotes were introduced in November 2016 as a swift measure to meet the economy’s currency requirement after the withdrawal of the ₹500 and ₹1000 notes. The objective was to expedite the availability of currency, which first subsequently achieved as Bank notes of other denominations became widely accessible.

Approximately 80% of the ₹2000 banknotes in circulation where issued before March 2017 and are nearing the end of the estimated life span of 4 to 5 years. The total value of this Bank notes has declined from its peak of ₹6.73 lakh crore (37.3% of notes in circulation) as of March 31, 2018 to ₹3 62 lakh crore, constituting only 10.8% of Notes in Circulation as of March 31, 2023. The observation is that the denomination is not commonly use for transactions, while an ample stock of banknotes of other denominations remain to fulfill the public’s currency requirements.

Inline “Clean Note Policy” of the RBI, it has been decided to withdraw the ₹2000 banknotes from circulation. This move aims to streamline the currency system and maintain the efficiency of note circulation.

Despite the withdrawal, it bits important to note that the ₹2999 banknotes will continue to be legal tender. Individuals possessing these banknotes can still use them for transactions or deposit them into their bank accounts.

This is not the first instance of RBI withdrawing banknotes from circulation. A similar measure was undertaken by the RBI in 2013-14.

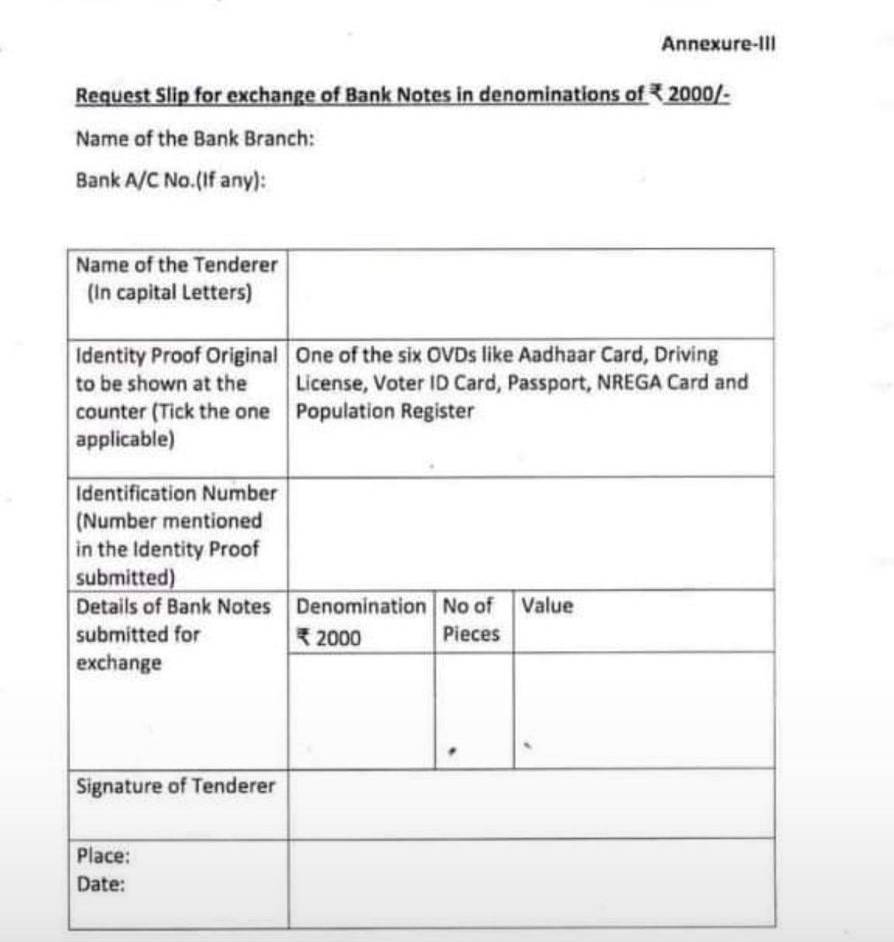

Members of the public can deposit their ₹2000 banknotes as per the usual procedures and applicable statutory provisions. Additionally, individuals can exchange these banknotes for banknotes of other denominations up to the limit of ₹20,000 at a time at any bank branch. This exchange facility will be available starting from May 23, 2023 to ensure operational convenience and minimize disruptions.

The withdrawal of the ₹2000 banknotes from circulation while retaining their legal tender status marks an important streamlining the currency ecosystem. Individuals are advised to deposit or exchange these banknotes within the specified timeline to avoid any inconvenience. The RBI’s decision aligns with their commitment to maintain an efficient and secure currency system in India.

Click here to see the PDF and learn more information!