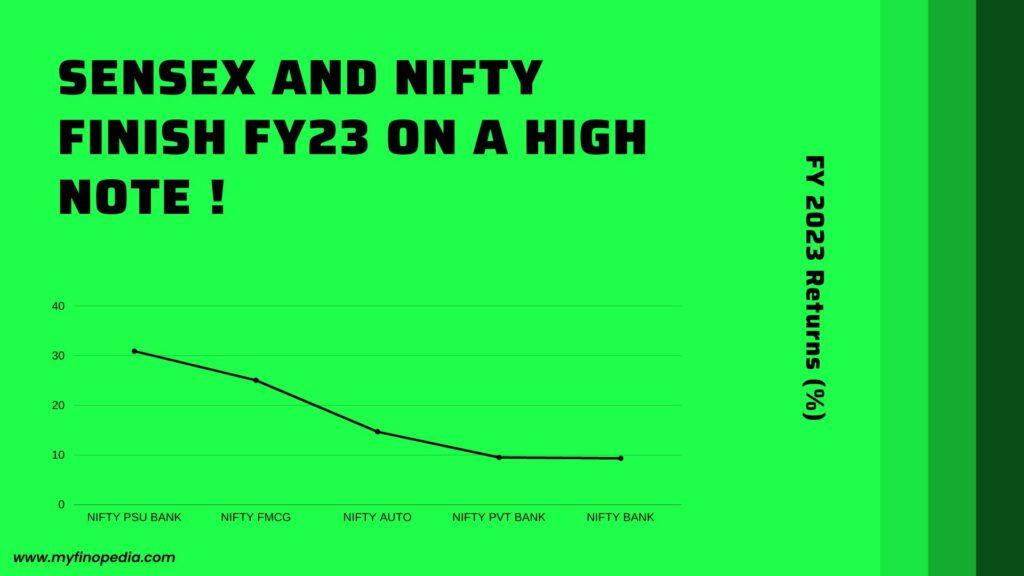

The Sensex and Nifty indices in India ended the FY 2022-2023 on a high note. The Sensex surged by 1,031 points, or 1.9%, to close at 52,925 on March 31, 2023. Meanwhile, the Nifty 50 rides to 308 points, or 1.8%, to end at 17,350.

The positive trend was visible across most sectors with IT sector leading Indian IT services company, saw it’s stock rise by 11% on the back of strong quarterly earnings. Other notable gainers included Boston Consulting Group and Reliance Industries, which rose by 6% and 3% respectively.

As of today, the top-performing sectors on the BSE were IT, Consumer Durables, and Healthcare. The IT sector was the clear leader, with a gain of 3.15%, followed by Consumer Durables, which rose by 2.56%. Healthcare also performed well, with a gain of of 1.57%. Other sectors, such as Auto, FMCG, and Metal, also registered gains, albeit more modest ones.

The Oil market, on the other hand, was the worst performer, with a decline of 0.71%. Other sectors that saw decline are Telecom, Infrastructure and Capital goods.

The strong performance of the Indian stock Market can be attributed to a number of factors. Firstly, the global economic recovery has had a positive impact on Indian stocks, as Investors remain optimistic about the country’s growth prospects. Secondly, the Indian government’s recent economic reforms and policy initiatives have boosted investor confidence. Thirdly, the ongoing vaccination drive against COVID-19 has helped to curb the spread of the virus, which has in turn boosted economic activity and consumer sentiment.

Looking ahead, analyst remain bullish on the Indian Stock market, with many predicting further gains in the coming months. However, they also caution that the market remains susceptible to volatility, and that investors should remain cautious and keep a long-term perspective.

The sector scan also provided a wealth of other data and insights into market trends. For example it highlights the top gainers and losers among individual stocks within each sector. It also provides information on the total market capitalisation of each sector, the number of stocks in each sector, and the percentage of stocks that are trading in the green or the red.

The strong finish to the financial year 2022-2023 bodes well for the Indian Stock market, and reflects the resilience and potential of the country’s economy. However, investors should remain vigilant and keep a close eye on market developments, in order to make informed investment decisions.