How to Save Tax in New Tax Regime

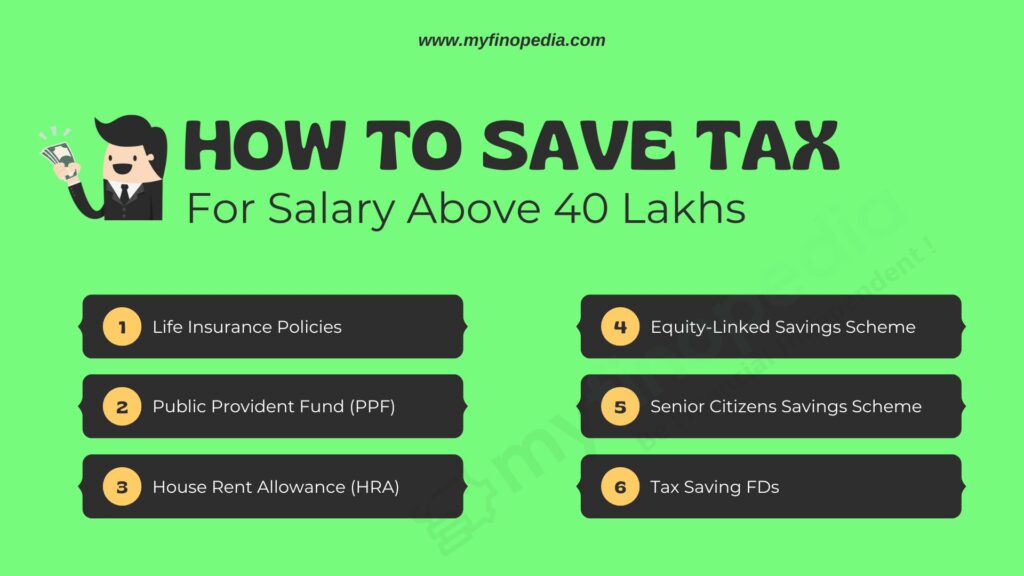

There are possibilities and challenges for taxpayers to maximize their tax savings with the introduction of the new tax framework. To minimize taxes and optimize financial well-being, it is imperative for both individuals and enterprises to comprehend the subtleties of the new system. In summary, navigating the new tax system calls for meticulous planning and …